Receivable Collection Period Formula

Free No Obligation Consult. In Business over 10 Years.

Average Collection Period Meaning Formula How To Calculate

Why is the average collection period important.

. Collection Period 365 Accounts Receivable Turnover Ratio Or Collection Period 365 6 61 days approx BIG Company can now change its credit term depending on its collection period. The Formula For Calculating the Average Collection Period. Accounts Receivable Money owed the company on credit for goods or services.

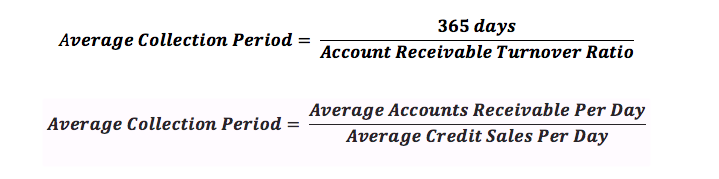

How to calculate the average collection period. Average accounts receivable is the sum of starting and ending accounts receivable over a time period. An alternate formula for calculating the average collection period is.

The average collection period formula is. Period 365 fracAverage. How to Calculate Your Accounts Receivable Collection Period.

365 days in a year divided by the accounts receivable turnover ratio. Formula for Calculating the Average Collection Period. In that case the formula for the average collection period should be adjusted as per necessity.

Trusted Back Tax Experts. The average collection period formula involves dividing the number of days it takes for an account to be paid in full by 365 days the total number of days in a year. Identifying this timeline is especially important for businesses that primarily rely on accounts receivable to fund their cash flow such as banks real estate and construction.

The average collection period calculation is simple. Thus the formula is. Average Collection Period Formula.

This number is then multiplied by. Your businesss AR collection period is calculated by dividing your accounts receivable turnover ratio for a given period typically a year by the number of days in that same period. We would use the following average collection period formula to calculate the period.

Calculating the average collection period for any company is important because it helps the company better understand how efficiently its collecting the money it needs to cover its expenditures. To calculate DSO divide 365 days into the amount of annual credit sales to arrive at credit sales per day and then divide this figure into the average accounts receivable for the measurement period. One formula for calculating the average collection period is.

Average collection periodfrac accounts receivable revenuedays in period average collection period revenueaccounts receivable days in period. Revenue eq Average Collection Period. The average collection period is calculated by dividing a companys yearly accounts receivable balance by its yearly total net sales.

Companies often assess their AR collection period annually. From the balance sheet in current assets. Calculating the Formula.

Which Is Better Low Or High Ttm Receivable Turnover. Average Accounts Receivable Net Credit Sales x Number of Days in Period Average Collection Period. The average collection period is calculated by taking the average amount of time it takes a company to receive payments on their accounts receivable AR and dividing it by the net Credit Sales.

Number of days 365 Amount owed. Compare us and Save. Average Collection Period Formula 365 Days Average Receivable Turnover ratio Average Collection Period 365 8 Average Collection Period 4562 or 46 Days.

The formula for net credit sales is Sales on credit Sales returns Sales allowances. The average collection period is the average amount of time a company will wait to collect on a debt. Net credit sales are sales where the cash is collected at a later date.

The average collection period is calculated by taking the average amount of time it takes a company to receive payments on their accounts receivable and dividing it by the net Credit Sales. The formula for calculating the Average Collection Period is as follows. The average collection period formula is eqAverage.

10000 100000 365 Average Collection Period The average collection period therefore would be 36. Then divide the result by the net credit sales. Example of Average Collection Period.

Ad Stop IRS Notices Garnishments. Businesses can measure their average collection period by multiplying the days in the accounting period by their average accounts receivable balance. ACP 365 Accounts Receivable Turnover.

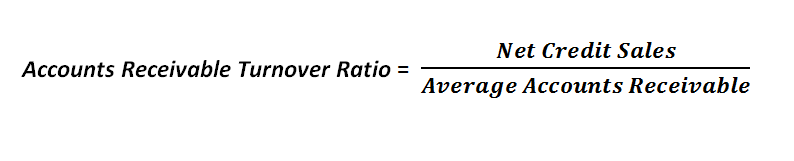

Accounts Receivable Turnover Ratio Net Credit Sales Average Accounts Receivable. What this result represents is how quickly your company can transform accounts receivable into cash. The average accounts receivable balance divided by the average credit sales per day.

Average Collection Period Meaning Formula How To Calculate

Accounts Receivable Collection Period Open Textbooks For Hong Kong

Average Collection Period Formula Calculator Excel Template

Average Collection Period Definition Formula Guide Ratio Example

0 Response to "Receivable Collection Period Formula"

Post a Comment